Unlocking Financial Freedom Through Passive Income

Do you ever feel like you’re stuck in a financial rut? You’re working hard, but you just can’t seem to get ahead? If so, you’re not alone. But, there’s hope! Unlocking financial freedom through passive income is the key to breaking out of the rat race and achieving true financial independence.

Passive income is money that you earn without actively working for it. This could come from investments, rental income, or even royalties from a book you wrote. The beauty of passive income is that it can be generated with minimal effort, allowing you to focus on other aspects of life.

The key to unlocking financial freedom through passive income is to create multiple streams of income. This means diversifying your investments and looking for new ways to earn money. With enough streams of income, you can eventually achieve financial freedom.

Passive income can provide you with the freedom to pursue your passions and live life on your own terms. You can travel, start a business, or simply enjoy life without worrying about money.

If you’re ready to take control of your finances and unlock financial freedom, passive income is the way to go. With a little bit of effort and the right strategies, you can achieve true financial independence and live the life you’ve always dreamed of.

Get Out of Debt and Achieve Financial Freedom

Are you feeling overwhelmed by debt and want to get out of it? Do you want to achieve financial freedom and finally be able to enjoy life without worrying about money? If so, then you need to get out of debt and achieve financial freedom.

Getting out of debt is not an easy task, but it is possible. It requires discipline, dedication, and hard work. You need to create a budget and stick to it, pay off your debt, and save for the future. You also need to create a plan to get out of debt and stick to it.

Once you have paid off your debt, you can start to achieve financial freedom. Financial freedom means having enough money to do what you want, when you want, and not having to worry about money. You can achieve financial freedom by creating a plan to save and invest your money, creating multiple streams of income, and living within your means.

Getting out of debt and achieving financial freedom is not easy, but it is possible. With the right plan and dedication, you can get out of debt and enjoy the freedom of financial freedom.

Investing Strategies for Achieving Financial Freedom

Achieving financial freedom is a goal that many of us strive for. It can be a difficult journey, but with the right investing strategies, you can make it happen. The key is to invest in a diversified portfolio of assets that will generate consistent returns over the long term. This means investing in stocks, bonds, mutual funds, real estate, and other asset classes. By diversifying your investments, you can reduce your risk and maximize your returns.

Another important investing strategy is to stay disciplined and stick to your plan. Investing can be volatile, so it’s important to stay focused and not get caught up in the day-to-day fluctuations of the markets. Instead, focus on the long-term goals and objectives that you have set for yourself. This will help you stay on track and stay focused on your financial freedom.

Finally, it’s important to be patient and to understand that investing is a long-term game. Don’t expect to become financially free overnight. It takes time and effort to build a portfolio that will generate consistent returns. Be patient and stay the course, and you will eventually reach your financial freedom.

By following these investing strategies, you can achieve financial freedom and live the life you’ve always wanted. With the right plan and the right investments, you can make your dreams a reality.

Budgeting for Financial Freedom

If you’re looking to take control of your finances and achieve financial freedom, budgeting is the key. Budgeting is a simple yet powerful tool that can help you reach your financial goals, no matter how big or small they may be. With a budget, you can track your spending, set financial goals, and make sure you’re staying on track.

Budgeting isn’t just about cutting back on spending; it’s also about setting yourself up for success. When you create a budget, you’re taking the time to plan out your expenses and income so that you can make the most of your money. You can set aside money for savings, investments, and other long-term goals. You can also use your budget to make sure you’re not overspending on things you don’t need.

Budgeting isn’t just about numbers; it’s also about creating a plan for your future. When you budget, you’re setting yourself up for financial freedom. You can use your budget to plan for retirement, save for a down payment on a house, or even take a dream vacation. Budgeting can help you make sure you’re staying on track and reaching your financial goals.

Budgeting isn’t always easy, but it’s worth it. With a budget, you can take control of your finances and achieve financial freedom. Take the time to create a budget and start planning for your future today.

Taking Control of Your Finances to Achieve Financial Freedom

Do you want to take control of your finances and achieve financial freedom? It’s a goal that many of us have, but it can be hard to know where to start. The good news is that with the right strategies and a bit of effort, you can take control of your finances and start building a secure financial future.

The first step is to create a budget. This will help you to track your income and expenses, and make sure you’re not spending more than you’re earning. Once you have a budget in place, you can start to look for ways to reduce your expenses and increase your savings. This could include things like cutting out unnecessary purchases, looking for cheaper alternatives, and setting up automatic transfers from your checking account to your savings account.

Another important step is to pay off any debt you have. High-interest debt can be a huge burden, and paying it off can free up more of your income for savings. You can start by focusing on the debt with the highest interest rate, and then work your way down.

Finally, it’s important to invest your savings. Investing can help you to grow your wealth over time and prepare for the future. You can start with a low-risk investment such as a savings account or money market fund, and then gradually move into higher-risk investments such as stocks and mutual funds.

Taking control of your finances is an important step towards achieving financial freedom. With a bit of effort and the right strategies, you can start building a secure financial future.

Excerpt

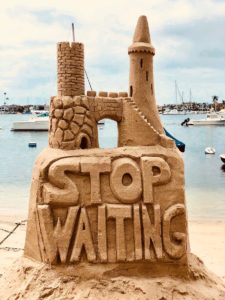

Achieving financial freedom is within reach! With the right strategy, you can create multiple streams of income and start living the life you’ve always dreamed of. So, don’t wait – start planning and take action today. You’ll be surprised by how quickly you can achieve financial freedom!